Sept. 27, 2018

Entrepreneurship and the family firm: Haskayne researcher wins impact award for research

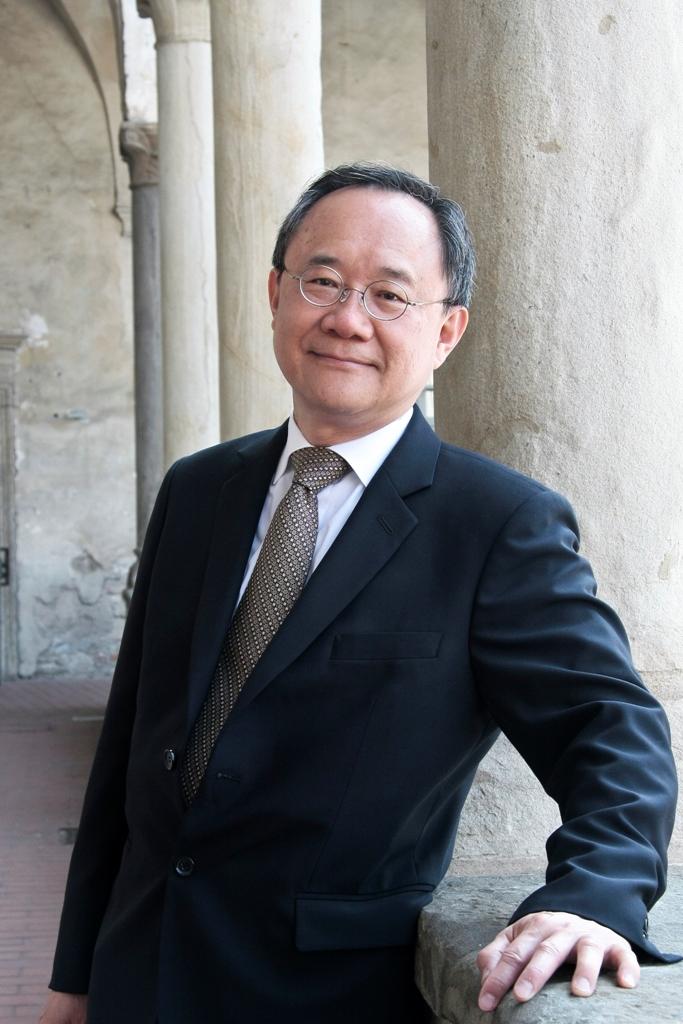

Jess Chua, professor emeritus of finance and family business governance.

Haskayne School of Business

“I find that as a pioneer one can have lasting impact on the field by studying the most important foundational issues,” says Dr. Jess Chua, PhD, professor emeritus of finance and family business governance in the Haskayne School of Business. He has been at the forefront of entrepreneurship research with a focus on investigating family firms — how they are different from widely held public corporations.

“In the middle of the 20th century, it was fashionable among business scholars to predict the demise of family firms — thinking they would be replaced by widely held publicly owned firms,” explains Chua. This has not happened. In fact, firms with significant family influence are present at all levels of the economic landscape — from your familiar mom-and-pop shops, to mid-sized regional corporations, to large global companies like Cargill and Walmart.

In fact, founding families are still involved in governing approximately 30 per cent of the largest U.S. publicly held companies, the S&P 500. As a result, family business research has become a rapidly growing field, especially in Europe, Asia, and South America where most of the businesses are heavily influenced by family involvement. Calgary researchers have been active in this field since the mid-1990s.

Consensus is now developing among scholars that family firms are different because they pursue different goals, have resources and capabilities that businesses without family involvement cannot develop, and adopt different governance structure and style. These affect behaviour and performance. Surprisingly, business scholars have paid the least attention to the goals pursued. Chua describes this as, “Instructing someone to go two miles and turn left without asking where they want to go.”

In the paper Family Involvement, Family Influence, and Family‐Centered Non‐Economic Goals in Small Firms published in Entrepreneurship Theory and Practice, which won the 2018 Greif Research Impact Award for the most impactful entrepreneurship article since publication five years ago, Chua and his co-authors examined why firms pursue family-centred non-economic goals. They found that leadership succession intention plays a very important role in family firms’ drive toward these non-financial goals. The paper also shows an important way forward for studying family firm goals through its approach for theoretical development and the empirical methodology used.

Chua grew up in a business family. That was a major reason for him to switch his research focus from finance to family business governance. His brothers, sisters, in-laws, nephews and nieces who run the family’s conglomerate together think that he, being a business professor, should be able to help them solve all their problems. He believes his switch in research focus has indeed enabled him to help.

Leadership succession goals in family firms is the next topic that Chua is set to explore. There has been no scientific study about the goals that family firms believe they can achieve through leadership succession by a family member and cannot achieve with a non-family successor.

“Family business leaders encounter succession only once in their lives. So this is an area where they have great need for input from scientific research.”